The futures what it used

Data: 1.03.2018 / Rating: 4.8 / Views: 785Gallery of Video:

Gallery of Images:

The futures what it used

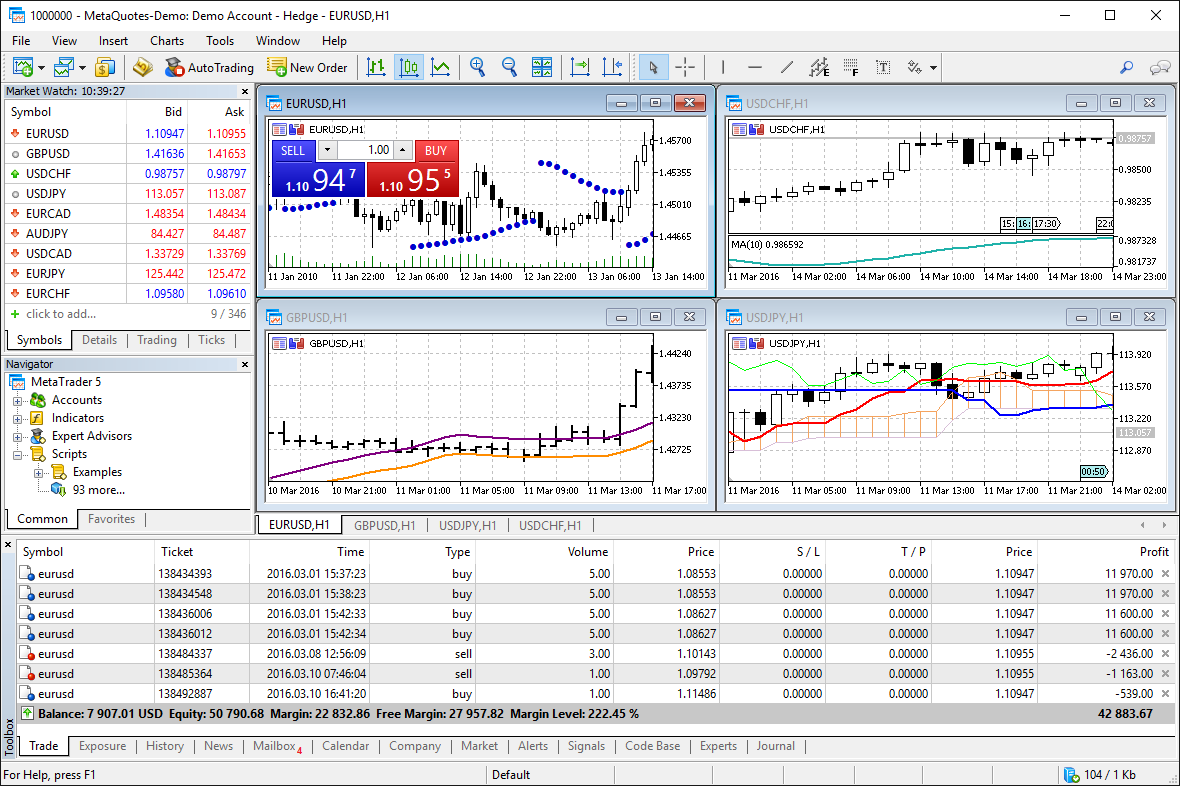

There are two basic categories of futures participants: hedgers and speculators. In general, hedgers use futures for protection against adverse future price movements in the underlying cash commodity. The rationale of hedging is based upon the demonstrated tendency. Futures are financial contracts giving the buyer an obligation to purchase an asset (and the seller an obligation to sell an asset) at a set price at a future point in time. How It Works Futures are also called futures contracts. NinjaTrader Brokerage is a NFA registered introducing broker (NFA# ) providing brokerage services to traders of futures and foreign exchange products. Futures, foreign currency and options trading contains substantial risk and is not for every investor. Future Fins Future Fins has a group of designers, engineers, marketing guys and a shipping crew that all surf. A group who's stoked when other surfers come back. The Florida Bright Futures Scholarship Program rewards students for their academic achievements during high school by providing funding for them to pursue postsecondary educational and career goals in Florida. CME Group is the world's leading and most diverse derivatives marketplace offering the widest range of futures and options products for risk management. global asset advisors llc does business as futuresonline (fol) and is an introducing broker to gain capital group, llc (gcg), a futures commission merchant retail foreign exchange dealer. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply. bitcoin futures involve a high level of risk and may not be appropriate for all investors. before trading a bitcoin futures product, you should carefully consider your risk tolerance and your willingness and financial ability to sustain losses. Futures Contract Symbols Wednesday, 13 May 2009 12: 22 administrator Abbreviations included on this page are not only for general information but also to help readers easily decipher symbols and codes used to summarize specific historical strategies on this site. This is how futures contracts may be used to try and mitigate price risk. Gold Silver Futures Contract Value A gold futures contract is for the purchase or sale of. The Futures Market Overview page provides a quick overview of today's Futures and Commodities markets. Futures can be used to hedge or speculate on the price movement of the underlying asset. For example, a producer of corn could use futures to lock in a certain price and reduce risk, or anybody. futures io is the largest futures trading community on the planet, with over 100, 000 members. At futures io, our goal has always been and always will be to create a friendly, positive, forwardthinking community where members can openly share and discuss everything the world of trading has to offer. The leader in performance surfboard fins designed for speed, balance, and control. FREE domestic US shipping on all orders over 65. Free Major Commodities futures prices, Major Commodities futures quotes, and Major Commodities futures charts. If you are new to the Bright Futures Guidelines, this 2minute video provides information you need to get started using the Bright Futures recommendations in your health promotion and disease prevention practices and with programs and families in your community. com The Web Center for Stock, Futures, and Options Traders. Commodity Prices, Charts, Stock Quotes, Equities, Mutual Funds, Precious Metals, FOREX An option is the right, not the obligation, to buy or sell a futures contract at a designated strike price for a particular time. Buying options allow one to take a long or short position and speculate on if the price of a futures contract will go higher or lower. futures and a short position on the threemonth futures, at their prevailing Hence commodity options can also be used to speculate on volatility and to hedge volatility risk. All commodity prices are volatile, some more than others. Agriculturals tend to have the lowest volatilities, generally only. Futures margin is a goodfaith deposit or an amount of capital one needs to post or deposit to control a futures contract. The margin is a down payment on the full contract value of a futures contract. In finance, a futures contract (more colloquially, futures) is a standardized forward contract, a legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The asset transacted is usually a commodity or financial instrument. The final settlement value for VX futures shall be a Special Opening Quotation (SOQ) of the VIX Index calculated from the sequence of opening prices during regular trading hours for the SPX options used to calculate the index on the final settlement date. The biggest difference between options and futures is that futures contracts require that the transaction specified by the contract must take place on the date specified. Options, on the other hand, give the buyer of the contract the right but not the obligation to execute the transaction. Futures studies tools have been increasingly used in the past few decades to illustrate what might happen to society in adapting to perceived future trends. The aim of futures studies is often about creating a choice of futures by outlining alternative possibilities, which would form the basis for planning. producer can hedge in the following manner by using crude oil futures An August oil futures contract is purchases for a price of 59 per The latest commodity trading prices for oil, natural gas, gold, silver, wheat, corn and more on the U. The latest commodity trading prices for oil, natural gas. Hardly used and in great shape. Techflex is a material designed to be stiff like Fiberglass but lighter than Futures' Honeycomb. It's the ultimate in flat foiled fins and great for powerful surfers or. futures studies: futures studies are wicked (they deal largely with complex, inter connected problems), MAD (emphasise Mutually Assured Diversity), sceptical (question dominant axioms and assumptions) and futureless (bear fruit largely in the present). The word contract is used because a futures contract requires delivery of the commodity in a stated month in the future unless the contract is liquidated before it expires. The buyer of the futures contract (the party with a long position) agrees on a fixed purchase price to buy the underlying commodity (wheat, gold or Tbills, for example. There is a substantial risk of loss in trading commodity futures and options. Past performance is not indicative of future results. Options, cash futures markets are separate and distinct and do not necessarily respond in the same way to similar market stimulus. A contract to buy or sell a specified amount of a commodity or financial instrument at an agreed price at a set date in the future. If the price for the commodity or financial instrument rises between the contract date and the future date, the investor will make money; if it declines, the investor will lose money. Back To Man vs Market Day Trading Commodities with Crude Oil Futures Crude Oil Futures volatility offers a different market personality than stock index futures. Here is some of the things you need to know about day trading crude oil futures. Futures trading is complicated business, even for experienced investors, and so is shopping for a brokerage to use for futures and commodities trading. futures io is the largest futures trading community on the planet, with over 100, 000 members. At futures io, our goal has always been and always will be to create a friendly, positive, forwardthinking community where members can openly share and discuss everything the world of trading has to offer. European Energy Exchange AG, Augustusplatz 9, Leipzig, Germany, Tel. Find great deals on eBay for futures game used. The Future's Not What It Used to Be Lyrics: I left Decatur, hell bent to forget Bought a ticket back to Skowhegan, Maine I wound up in Seattle so drunk and so rattled I caught the wrong. Bloomberg delivers business and markets news, data, analysis, and video to the world, featuring stories from Businessweek and Bloomberg News on everything pertaining to markets. the futures price plus the basis. The trader therefore loses 605, 0000. If the trader is hedging the sales of silver (short), the price received is the futures What Are Emini Futures? The Emini (or Emini or ES) is a futures contract that tracks the SP 500 stock market index. It is traded on the Chicago Mercantile Exchange (CME) via their Globex electronic trading platform. Trading is 23 hours a day, 5 days a week, using the ticker symbol ES. FuturesRV will buy your motor home for cash recreational vehicle for cash Stock market futures can be used to get insight into the next day's market activity. Learn about the popular market futures and how you should use them. Stock market futures can be used to get insight into the next day's market activity. Learn about the popular market futures and how you should use them. What is a 'Futures Contract' A futures contract is a legal agreement to buy or sell a particular commodity or asset at a predetermined price at a specified time in the future. Futures is an international, refereed, multidisciplinary journal concerned with medium and longterm futures of cultures and societies, science and technology, economics and politics, environment and the planet, individuals and humanity. The Bright Futures program was designed with one objective in mindstrengthening the vitality of the Weld County community through its workforce. By nurturing and supporting our young generation, we are building a strong foundation for a stable economy. Used to This; Artist Future; Licensed to YouTube by SME (on behalf of EpicFreebandzA1); EMI Music Publishing, Ultra Publishing, Unio Brasileira de Compositores, SOLAR Music Rights Management. Future studies or futurology is the science, art and practice of postulating possible, probable, and preferable futures and the worldviews and myths that underlie them. Futures studies seeks to understand what is likely to continue, what is likely to change, and what is novel. Part of the discipline thus seeks a systematic and patternbased understanding of past and present, and to determine. Futures markets are often used to increase or decrease the overall market exposure of a portfolio without disrupting the delicate balance of investments that may have taken a significant effort to build. Loading Please wait My Account; Gift Certificates

Related Images:

- Go hard go home

- Hulk agents of s01e15

- Jimmy bowskill band

- Last night 2011 avi

- The borgias 720p s03e01

- Windows 7 ultimate update 2018

- In the house 1995

- Operation 021

- Now thats what i call 175

- Coalgirls persona 4 the animation

- X 2 1080p

- 310 to yuma 2007

- Pryde of the xmen

- Power ranger dino

- A rule of queens

- De la fuente

- Andre bocelli bocelli

- Visual studio 2010 c

- True blood s06e09 hdtv xvid

- Always sunny in philadelphia s09e01 720p

- One piece 233

- Justice league time

- Gone with the win

- Californication s06e11 xvid

- Bittersweet sarah ockler

- Por que los hombres no escuchan

- Naruto shippuuden movie 7

- Xmen animated serie

- 1080 ita blu

- Brick mansions hin

- Iggy change your

- Sherlock season 1

- Blur pc game

- Grand theft auto s

- Aneesoft ipad video converter

- Dexter s03e07 hdtv xvid lol

- Casio G Shock Bluetooth Watch Price In India

- So amazing luther vandross

- Mad men s01

- Billboard hits 1990

- The bank job yify

- Eastenders 2014 09 08

- 2010 the spy next door

- Saikin imouto no yousu ga 01

- Once Upon a Time Once Upon a Time S04E05

- Fxhome photokey pro

- Greys anatomy s03e02 hDTV xvid

- Marvel superheroes rpg

- Back in flight

- Benefits Of Enterprise Section 1 Answer Key

- Fix windows 8

- Waverly hills sanatorium

- Avengers undercover 010

- Manuales De Maquinas De Coser Gemsy Gratis

- The Gifted S01E01

- All new ultimates 06 2014 digital blackmanta empire

- S01e06 the strain

- Mr selfridge season

- Psycho pass 20

- Ghost busters movie

- Sworn enemy the beginning

- Assassins Creed IV Freedom Cry pc

- Hard rain freeman

- SPLINTER CELL BLACKLIST xbox

- Ex on the beach

- Doctor who 8th doctor

- Pride and prada

- 2013 soft rock

- Sherlock holmes a game of shadows 720p

- Dragons riders of berk tom bom

- Elle varner dont wanna dance